MVNOs are providers of mobile communication services that have their own customer base but not their own telecom infrastructure. In order to offer these services, they lease and use the network of a mobile telecom operator.

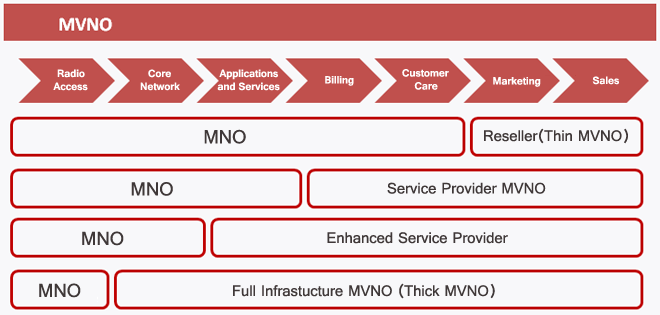

A broad range of operational models were tested, from the lightweight “reseller” MVNO that essentially re-sells minutes/SMSs/data bought from an HNO, through to the “thick” or “full service” MVNO that operates its own customer care, billing system and even parts of the core network.

MVNOs may also be classified according to their customer business model; they concentrate on specific market segments: low-cost, youth, business or ethnic categories.

Reseller MVNOs – they usually have a well known brand and a complex retail infrastructure and focus on sales and on leveraging customer relationships. They resell services on margins, the pricing being agreed with the HNO. They have control over their sales and marketing processes, but they usually differentiate only on pricing, brand identity and value.

The main advantages of this model are its fast time to market, low startup costs and HNO availability to embrace this model as it is not perceived as a real threat to their traditional business, enabling them to enjoy complete control over most of the MVNO’s business processes; furthermore, resellers use HNO/MVNE-provided SIM cards and the HNO maintains all customer details.

Service provider MVNOs – supplementary to the reseller, the service provider MVNOs manage all customer care processes, including the CRM, customer support, self care and billing processes from flexible account lifecycle, complex tariff bundles and packages, voice, data and SMS services. The Service provider model suits businesses with brands or service concepts that differentiate them from existing players

Enhanced Service Providers – in addition to their own billing and customer care processes, enhanced service providers usually have their own infrastructure which allows them to have complete control over their business and service offerings. The enhanced service providers usually run their own value added services platforms such as voicemail, missed call notification, VPN. Having their own infrastructure, MVNOs become serious competitors for HNO in terms of price and service offerings.

Full infrastructure MVNOs- full infrastructure MVNOs have complete control over the operations, data and services launched due to certain core network nodes such as the GMSC (Gateway Mobile Switching Centre) or HLR (Home Location Register). Such MVNOs operate in similar way to any HNO, but without their own radio network. Full infrastructure MVNOs also have their own SMSC (Short Message Service Centre), MMSC (Multimedia Messaging Service) and GGSN (Gateway GPRS Support Node) allowing full control over all the services they offer in the market and flexibility in designing and deploying new services. Full service MVNOs can have their own roaming and interconnect agreements.

In the long term, this business model might benefit all consumers and players in the market. Spectrum shortage has allowed only 3 to 5 mobile service providers to operate with a full infrastructure in a country via an expensive and prolonged licensing process. Using such advanced MVNO business models, competition will develop a healthy climate for everybody and advantages for all those involved: the newcomers, incumbents and, most of all, the end customers. The Full MVNO model suits businesses that aim to totally embrace the telecom opportunity, to differentiate through innovative services, to enhance an existing customer base and to create and grasp new markets.